The Guide to Stock Options conversations

Why every manager should talk to their employees about stock options

TLDR: you should help your employees make sense of their stock options.

When they start, help them understand how different scenarios will play out for them.

If they stay for a long time or are promoted - make sure they get additional grants.

When they leave - help them gather the information they need to make a decision. Explain the 3 different scenarios, and how it’ll affect them - the company going bankrupt, being sold for the current valuation, and being sold for 10X.

Stock options help you align the employees' interests with the company's success.

People don’t talk about stock options for multiple reasons:

The “Assume your equity will be worth nothing” mantra. Especially in 2024, people prefer to treat stock options as a lottery ticket and not as an investment.

All the (unneeded) secrecy around the compensation package - you are not allowed to talk about your salary and stock options with other employees, and in some places not even with your manager.

Companies make it hard to understand the value of your stock options.

They mentioned that it’s our role as managers to:

…Give people the info they need to think critically about equity. That means thinking about the probability of options being worth a lot vs. nothing vs. somewhere in the middle.

Without equity, a startup job is just another job! Companies may see employees walking away from equity as letting them keep more for themselves. But this is terribly short-sighted, it takes away a major motivational factor for employees to work hard and stick with the company.

I’m going to try to help you do that. You can also do your employees a favor, and just forward them this article :)

But first, a basic explanation of stock options:

Stock Options 101

For a deeper explanation, read this article.

Every company, including private ones like startups, is divided into parts called shares. These shares represent ownership in the company. For example, if a company has 1,000 shares in total and you own 200 of them, you own 20% of the company.

Stock options are a special deal companies offer to their employees, giving them the right to buy shares at a specific price, known as the exercise price (or grant price/strike price), after a certain period has passed. This is a way for companies to reward employees and encourage them to stay longer and work towards making the company more successful.

If the company's value increases, so does the value of its shares. This allows employees to buy shares at the lower exercise price and potentially sell them at a higher market price, making a profit.

Stock options align the employees' interests with the company's success.

The New Employee Conversation

The sad truth is that companies make it very hard for people to understand the numbers behind stock options:

Marco: When employees try to learn more about equity, they can end up feeling like they’re not smart enough to understand the value of their equity and I think that's on purpose.

Jen: I know for a fact that recruiters at many companies don’t want you to ask too many questions.

Marco: I would go even further than that – the information imbalance has the deck stacked against employees. Companies don’t provide all the information that employees need to make informed decisions. So that’s one reason people simply opt out of the conversation altogether.

When starting at a startup, an engineer usually gets a stock options grant, with a 4-year vesting period, with 1-year cliff. What they don’t know, is what they’ve actually got. What’s the worth of those options?

You can help them with 3 simple questions:

1. Do they know the exercise price?

This is the basic value they’ll need for any future discussion. What is the price they’ll need to pay to buy the share?

In some companies, the initial job contracts are misleading, and mention a nominal price of $0.01. In reality, when you get the option grant contract (usually after the next board meeting), it’s a higher value.

2. Do they know the current price of each share?

In my opinion, this should be discussed during the contract phase, but this is rarely the case, as companies deem it private information.

The crazy part is that even after you join - if you don’t ask, nobody will tell you.

This information can help you understand if you are ‘in the money’ - meaning the exercise price is lower than the current share price.

3. Do they know what they stand to gain in a liquidation event?

A liquidation event = an Acquisition / Merge / IPO / Secondary sale.

You can play out a hypothetical scenario with them, just to explain the concept: “Let’s you got 1000 options, with an exercise price of $10, and the current share price is $15.”

What can they gain if they sell for the current share price? - They’ll need to pay $10K, and will get $15K - a $5K profit.

What will they gain in the 10X scenario? - They’ll pay the same $10K, but will get $150K - a $140K profit. Note that the bigger the company grows, the less impact the exercise price has.

This calculation doesn’t take into account the dilution during future funding rounds.

Are they excited about the 10X scenario?

If after having this conversation, the employee is left with the feeling: ”hmmm, even in the 10X scenario that’s not too much, I thought I’d make more” - you need to discuss it with your manager. Maybe you need to offer better packages.

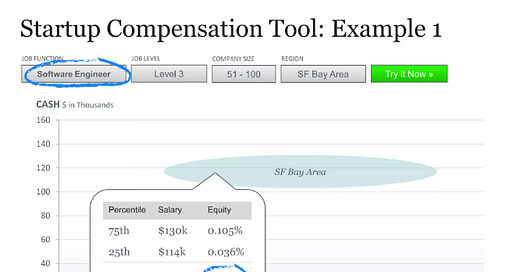

This article offers a valuable perspective to see if your company is good at incentivizing employees:

A Tenured/Promoted Employee

I’ll not get too deep into that, if you want to read about the best practices of additional stock options grants, go read the article mentioned above.

Just make sure you have a grasp of how it works in your company. You’ll be surprised how much you can affect those things.

A Leaving Employee

Marco shared his story in the article:

After Yammer, I joined another startup as the first engineer, and I ended up vesting quite a bit of equity. When it was time to leave, I had some very serious conversations with my family. We made the bet and put down a lot of money to exercise, then spent 3.5 years waiting. Finally, the news came that the company was going public, and I got an even bigger check than I had from Yammer. I started reconnecting with coworkers and it was… heartbreaking.

Just heartbreaking. People told me, “I didn't understand equity, it seemed too expensive to exercise, so I didn’t do anything.” It’s tough, because the period I worked for that company was pretty grueling, but I can tell you what makes up for it: money. Money makes up for a lot of regret. It really solidified the stance that I'm laying out right now, which is that you can't ignore the value of equity.

Do NOT take this story as advice that you should tell your employees to always exercise their options! That is definitely not the case.

The lesson is that most people approach this decision in ignorance. They think something along the lines of: “I need to pay $30K to exercise my options. The chances of actually seeing money from it are very low, so it’s not worth that money”.

Let’s say your employee vested 1000 shares, with an exercise price of $30 for each. So to exercise (=buy) all of them, they’ll need to spend $30K, not a small sum.

In my opinion, it’s our job as managers to help them make the right decision, for THEM.

What do they need to consider before making the decision:

1. What is the current share price?

Similar to the question in the first section - this is the most critical question, it is the value the investors in the last round paid for their shares.

There is a HUGE difference between these 2 cases:

A current share price of $50, which prices your shares at $50K. In this case, if you don’t buy the shares, you are leaving $20K ‘on the table’.

A current share price of $300. In this case, your shares are priced at $300K right now, and you’ll be leaving $270K ‘on the table’.

2. What is the company’s chance of success?

As an insider, people think they have better knowledge, but usually, they just get emotionally involved in the decision. I don’t have data to back that up, but I’m sure that employees that were fired, are much less likely to exercise their options. Their logic could be “If this company chose to fire a great employee like me, there is no chance they’ll succeed”.

It’s much better to use cold data and take into account the stage of the company. This is just an example, you don’t really need exact numbers:

3. What are you willing to spend on the investment?

Buying your shares is NOT a bet, but an investment. The employee needs to decide if they want to make it, and how much to spend on it.

It’s not all-or-nothing! They can buy just some of their shares. If they are not willing to spend any money, they can use companies such as Equitybee, which lets “you exercise your stock options with no out-of-pocket cost so you can profit from a future IPO.” [Not sponsored, and I’ve never tried them].

Combining it all for a final decision

Once they have the information, they need to consider 3 options:

You will lose 100% of your investment - the most likely option. Will you be angry at yourself for spending that money? Will it create a conflict in the family? Or will you be able to brush it off?

The company will be sold close to the current value - how much will you make?

The company will be sold for 10x the current value - how will you feel if won’t be a part of it? Is it a life-changing event, and you will regret it your whole life?

In the end, only the employee can make that decision, but you can provide A LOT of help in gathering the information and laying out the facts.

It’s important to understand that this could be one of the most critical investment decisions the employee will make their whole life. And as such, it needs to be considered carefully. I would even go as far as to recommend talking to a financial advisor for personalized advice.

Final Words

I know that most people think that I went a little overboard with the guidance to employees. Until the companies do a better job of it, and there will be better education and common knowledge - I think it’s our job as managers to fill the gaps.

If the subjects of stocks, VCs, and money interest you, I recommend you subscribe to

and .What I enjoyed reading this week

This is BY FAR the best article I’ve read on 1:1 meetings, by

What we should do to make our teams miserable (the inversion mental model) by

The multiple forms of leadership - Manager, Leader, Mentor, by

Thank you so much for the mention, Anton! I appreciate it.

Great article! As someone who had to learn it by myself, I know it can be an overwhelming topic.

I see three factors that make the situation worse:

1. overall taboo around talking about compensation

2. companies not investing in the education of their employees

3. generally insufficient financial literacy in the society

But since employees negotiate the compensation package before they start in the company, they shouldn't rely on point 2 but educate themself as much as possible upfront.

Great post. In my first job, when I handed my resignation, my manager suggested to wait for a week because my stock was vesting.

It was for a start up but that simple wait was all worth it when it went public 3 years later!

I could totally relate, and this truly makes a manager great! I like to talk about it in the care personally dimension of leadership.